Unlocking the Hidden Potential of Your Home: A Guide to Leveraging Equity for Investments

As a homeowner, you’re sitting on a goldmine – literally. The equity in your home can be a powerful tool for financing investments, achieving financial freedom, and securing your future. But how do you tap into this treasure trove without putting your home at risk? In this article, we’ll break down the ins and outs of leveraging equity in your home for investments, so you can make informed decisions and unlock the full potential of your property.

First, let’s talk about what equity is and how it works. Equity refers to the difference between your home’s market value and the outstanding balance on your mortgage. For example, if your home is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity. This is essentially the portion of your home that you own outright, free from any mortgage or lien obligations.

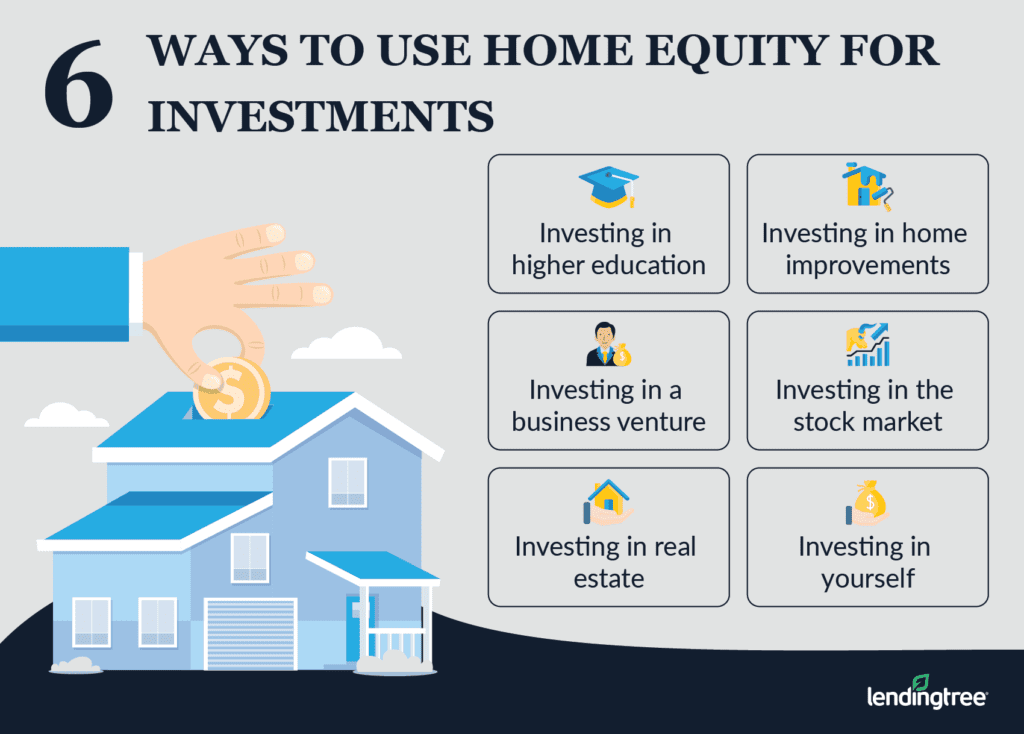

Now, let’s explore the different ways you can leverage equity in your home for investments:

- Home Equity Loan: A home equity loan is a type of loan that allows you to borrow a lump sum of money using your home’s equity as collateral. The loan is typically secured by a second mortgage on your home, which means you’re essentially using your home as a guarantee for the loan. This type of loan is ideal for one-time investments or expenses, such as financing a down payment on an investment property or covering unexpected medical bills.

Example:

Let’s say you have $100,000 in equity in your home and you want to invest in a rental property that requires a $50,000 down payment. You could take out a home equity loan for $50,000, using your home’s equity as collateral, and use the funds to cover the down payment on the rental property.

- Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that allows you to borrow and repay funds as needed, using your home’s equity as collateral. This type of loan is ideal for ongoing expenses or investments, such as financing a home renovation project or covering college tuition fees.

Example:

Let’s say you’re planning to renovate your kitchen and need to cover expenses of $10,000. You could open a HELOC for $20,000, using your home’s equity as collateral, and draw on the funds as needed to cover renovation expenses.

- Cash-Out Refinance: A cash-out refinance involves refinancing your existing mortgage to take advantage of lower interest rates or to access cash for investments. This type of loan is ideal for consolidating debt or accessing cash for large purchases.

Example:

Let’s say you’re paying 4% interest on your existing mortgage and interest rates have fallen to 3%. You could refinance your mortgage to take advantage of the lower interest rate and access cash for investments, such as paying off high-interest credit card debt.

Risks and Considerations

Before leveraging equity in your home for investments, it’s essential to consider the risks and potential consequences. Here are a few things to keep in mind:

- Risk of foreclosure: If you fail to repay a home equity loan or HELOC, you risk losing your home to foreclosure.

- Debt obligations: Leveraging equity in your home for investments means taking on additional debt, which can impact your credit score and financial stability.

- Market volatility: Markets can be unpredictable, and investments can result in losses or decreased value.

Best Practices for Leveraging Equity in Your Home

To minimize the risks and maximize the benefits of leveraging equity in your home, follow these best practices:

- Consult with a financial advisor: Before making any decisions, consult with a financial advisor to determine the best course of action for your individual circumstances.