Unlocking Hidden Gems: Evaluating the Potential of Opportunity Zones for Investment

As the hunt for yield and potential for long-term growth continues to drive investment decisions, Opportunity Zones have emerged as a promising area of focus for savvy investors. Created as part of the Tax Cuts and Jobs Act of 2017, Opportunity Zones are designed to stimulate economic growth and job creation in distressed communities across the United States. But what exactly are Opportunity Zones, and do they live up to their promise as a viable investment opportunity?

Understanding Opportunity Zones

Opportunity Zones are low-income census tracts designated by state governors and certified by the US Department of the Treasury. These areas have historically been plagued by high unemployment, poverty, and disinvestment. The goal of the Opportunity Zone program is to incentivize investment in these areas by offering significant tax benefits to investors.

The Benefits of Investing in Opportunity Zones

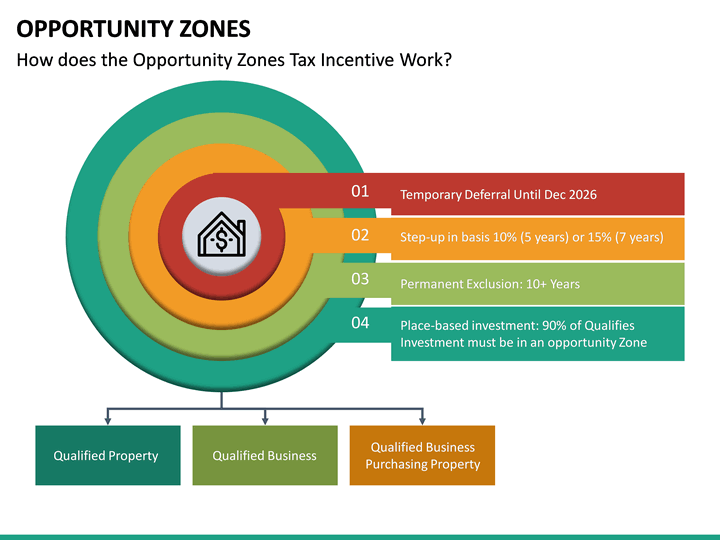

So, what makes Opportunity Zones an attractive investment proposition? The answer lies in the tax benefits that come with investing in these areas. Here are a few key benefits to consider:

- Tax Deferral: Investors can defer capital gains taxes on investments made in Opportunity Zones until the end of 2026, or until they sell their investment.

- Tax Reduction: Investors can reduce their capital gains taxes by up to 10% if they hold their investment for at least 5 years, and up to 15% if they hold it for at least 7 years.

- Tax-Free Growth: If an investor holds their investment in an Opportunity Zone for at least 10 years, they can sell it tax-free.

Evaluating the Potential of Opportunity Zones

While the tax benefits of investing in Opportunity Zones are undeniable, it’s essential to approach these investments with a critical eye. Here are a few factors to consider when evaluating the potential of Opportunity Zones:

- Location, Location, Location: Opportunity Zones are located in areas with significant social and economic challenges. Investors should carefully research the local economy, infrastructure, and demographics before making an investment.

- Project Viability: Investors should evaluate the viability of proposed projects in Opportunity Zones, including the project’s financials, management team, and potential for growth.

- Regulatory Environment: Investors should stay up-to-date on regulatory changes and updates to the Opportunity Zone program.

Investment Options in Opportunity Zones

Opportunity Zones offer a range of investment options, from real estate development to small business lending. Here are a few investment options to consider:

- Real Estate Development: Opportunity Zones are prime areas for real estate development, including affordable housing, office buildings, and retail spaces.

- Small Business Lending: Opportunity Zones are home to many small businesses, and investors can make a positive impact by providing lending support to these entrepreneurs.

- Infrastructure Development: Opportunity Zones require significant investment in infrastructure, including roads, bridges, and public transportation.

Conclusion

Opportunity Zones offer a unique combination of tax benefits and potential for long-term growth, making them an attractive investment proposition. However, investors should approach these investments with caution and carefully evaluate the potential of each Opportunity Zone. By doing their due diligence and selecting projects with strong viability, investors can unlock the full potential of Opportunity Zones and create positive change in distressed communities.

As the Opportunity Zone program continues to evolve, it will be essential to stay informed about regulatory updates and changes to the program. With careful evaluation and a long-term perspective, Opportunity Zones can be a valuable addition to any investment portfolio.