Understanding the ebbs and flows of the real estate market is essential for anyone looking to invest in property. Real estate cycles, also known as market cycles, refer to the periodic fluctuations in the market that can significantly impact the value of your investment. In this article, we’ll delve into the world of real estate cycles and explore how they affect investments.

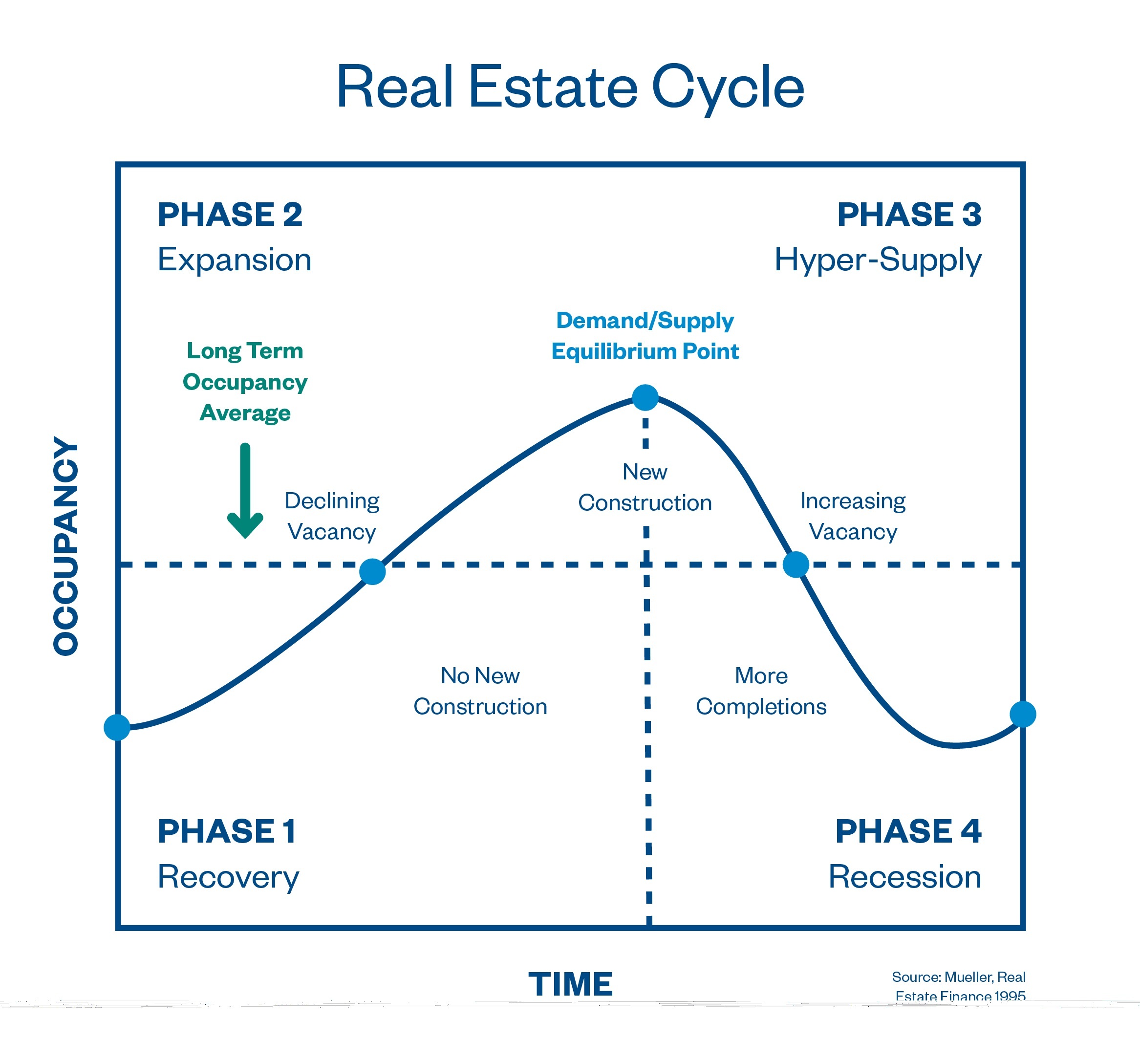

Think of real estate cycles like the tides of the ocean. They move in a predictable pattern, with each phase influencing the next. The cycle typically consists of four distinct phases: expansion, peak, contraction, and trough. Each phase has its unique characteristics, and understanding them can help you make informed investment decisions.

The Expansion Phase: A Time for Growth

During the expansion phase, the real estate market experiences a surge in demand, leading to rising prices and increased construction activity. This is often triggered by economic growth, low interest rates, and government incentives. As the market expands, investors can enjoy significant returns on their investments. However, it’s essential to be cautious during this phase, as the market can become overheated, leading to a crash.

The Peak Phase: A Warning Sign

The peak phase marks the height of the market cycle, where prices reach their maximum level. At this point, the market becomes saturated, and demand begins to slow down. Investors may begin to feel a sense of unease as the market stabilizes, and prices stop rising. This phase is critical, as it can signal the start of a correction.

The Contraction Phase: A Time for Caution

As the market contracts, prices begin to fall, and the number of transactions decreases. During this phase, investors may experience financial losses, and some may even abandon their investments. However, it’s not all doom and gloom. The contraction phase can also present opportunities for savvy investors who can identify undervalued properties.

The Trough Phase: A Time for Rebirth

The trough phase marks the bottom of the market cycle, where prices are at their lowest point. This phase is characterized by a lack of demand, and many investors may be hesitant to enter the market. However, for those who are brave enough to invest during this phase, the rewards can be significant. As the market begins to recover, prices will rise, and investors can enjoy substantial returns.

How Real Estate Cycles Affect Investments

Understanding real estate cycles is essential for making informed investment decisions. Here are a few ways that cycles can impact your investments:

-

Property Values: Real estate cycles can significantly impact property values. During the expansion phase, values may increase, while during the contraction phase, values may decrease.

-

Cash Flow: Cycles can also affect cash flow. During the expansion phase, rental income may increase, while during the contraction phase, rental income may decrease.

-

Financing: Cycles can influence financing options. During the expansion phase, lenders may be more willing to lend, while during the contraction phase, lenders may be more cautious.

Tips for Navigating Real Estate Cycles

While real estate cycles can be unpredictable, there are several strategies that you can use to navigate them:

-

Stay Informed: Keep up-to-date with market trends and news. This will help you anticipate changes in the market and make informed decisions.