Stepping into the world of real estate investing can be a thrilling experience, especially for young adults in their 20s. As a young investor, it’s natural to have high ambitions and a willingness to take calculated risks. However, investing in real estate at a young age also comes with its pros and cons.

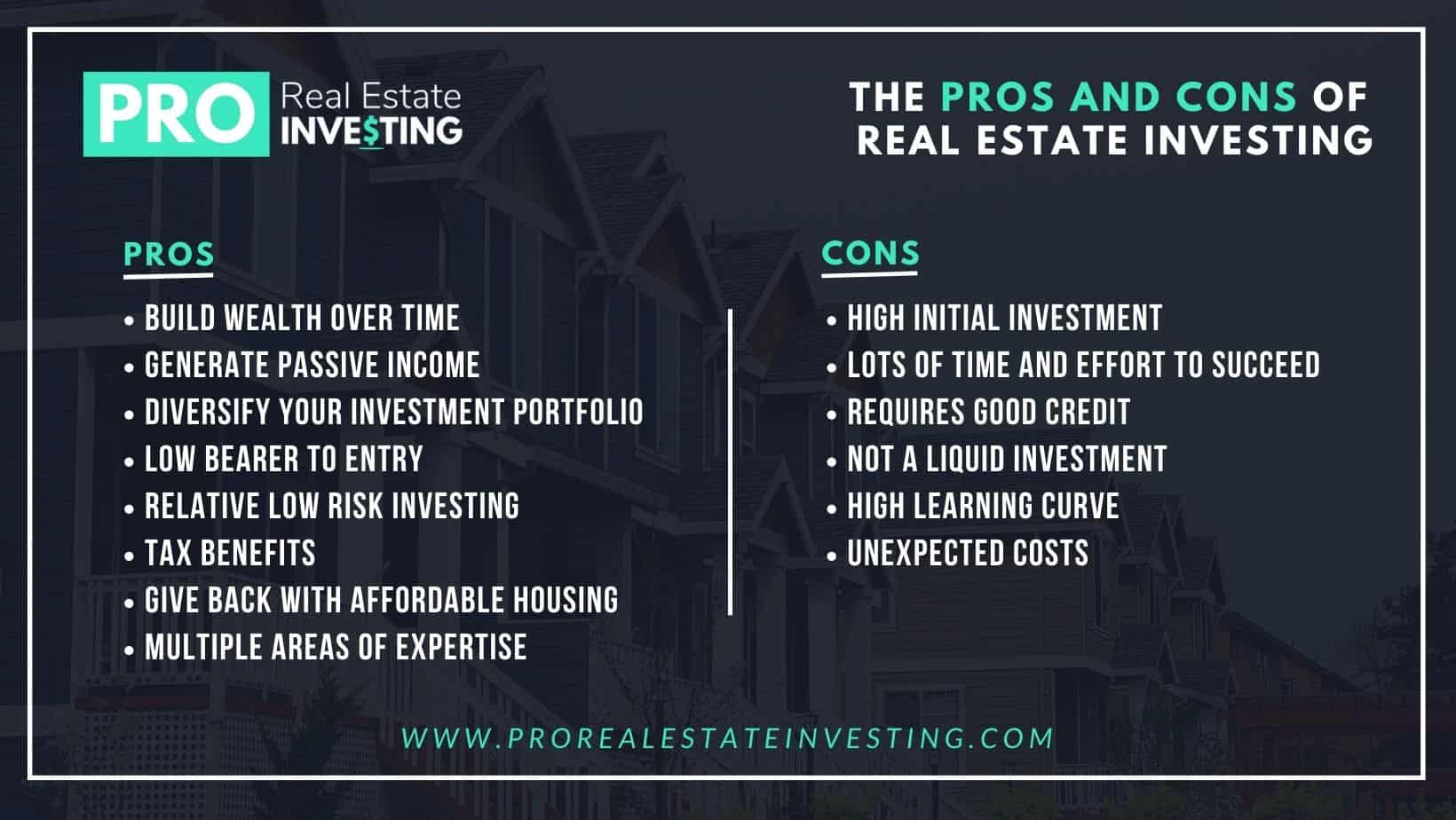

On the one hand, investing in real estate in your 20s can be an excellent way to build wealth and secure your financial future. For one, it allows you to get started early, thereby giving you more time to reap the rewards of compound interest and growth. With real estate, you’re essentially investing in a tangible asset that can appreciate in value over time, providing you with a steady stream of passive income.

One of the main benefits of investing in real estate at a young age is that you can tap into the potential of long-term growth. As you hold onto the property, you can expect its value to increase over time, thanks to inflation, demographic shifts, and infrastructure development. This means that your initial investment can snowball into a significant amount, providing you with a sizeable nest egg for the future.

Moreover, owning real estate can also provide you with tax benefits. As a property owner, you’re entitled to deductions on mortgage interest, property taxes, and maintenance expenses, which can help offset your taxable income. This can result in significant savings, especially if you’re in a high tax bracket.

However, investing in real estate in your 20s also comes with its fair share of challenges. For one, it often requires a significant amount of upfront capital, which can be a hurdle for young investors who may not have access to substantial savings or credit. In addition, real estate investing involves a range of responsibilities, from property maintenance to tenant management, which can be time-consuming and emotionally taxing.

Another con of investing in real estate at a young age is that it can tie up a significant amount of your capital, making it less liquid than other investment options. This means that if you encounter unexpected expenses or need to access your funds quickly, you may be unable to do so without incurring significant penalties or losses.

Furthermore, real estate investing involves inherent risks, such as market fluctuations, regulatory changes, and unforeseen maintenance expenses. As a young investor, it can be challenging to navigate these complexities, especially if you don’t have a solid understanding of the market or the right professional guidance.

So, is it wise to invest in real estate in your 20s? The answer is yes, but with caution. Before taking the plunge, it’s essential to educate yourself on the intricacies of real estate investing, assess your financial readiness, and carefully weigh the pros and cons.

Here are some tips to help you get started:

- Develop a solid understanding of real estate investing: Learn about different types of investment properties, such as rental properties, fix-and-flip projects, and real estate investment trusts (REITs).

- Assess your financial readiness: Calculate your savings, credit score, and cash flow to determine whether you’re ready to invest in real estate.

- Develop a long-term strategy: Real estate investing is a long-term game, so it’s essential to have a clear strategy and patient mindset.

- Diversify your portfolio: Don’t put all your eggs in one basket – consider diversifying your portfolio by investing in different asset classes, such as stocks, bonds, or other types of real estate investments.

- Seek professional guidance: Consider working with a real estate agent, financial advisor, or property manager to help you navigate the process and avoid costly mistakes.

In conclusion, investing in real estate in your 20s can be an excellent way to build wealth and secure your financial future. However, it’s crucial to approach this investment option with caution, carefully weighing the pros and cons, and taking the time to educate yourself and assess your financial readiness. With patience, persistence, and the right guidance, you can navigate the world of real estate investing and set yourself up for long-term success.