Real estate investment has long been a coveted wealth-building strategy, but it often seems inaccessible to small investors. The high upfront costs, property management responsibilities, and significant risk involved can be daunting for those who don’t have deep pockets or extensive experience. However, there’s a game-changing alternative that allows small investors to participate in the lucrative world of real estate: real estate syndication.

In essence, real estate syndication is the pooling of funds from multiple investors to invest in a larger property or project. This collaborative approach enables small investors to tap into the benefits of real estate investing without shouldering the entire burden alone. By joining forces with other investors, you can diversify your portfolio, reduce risk, and enjoy the potential for higher returns.

So, how does real estate syndication work? Here’s a simplified overview:

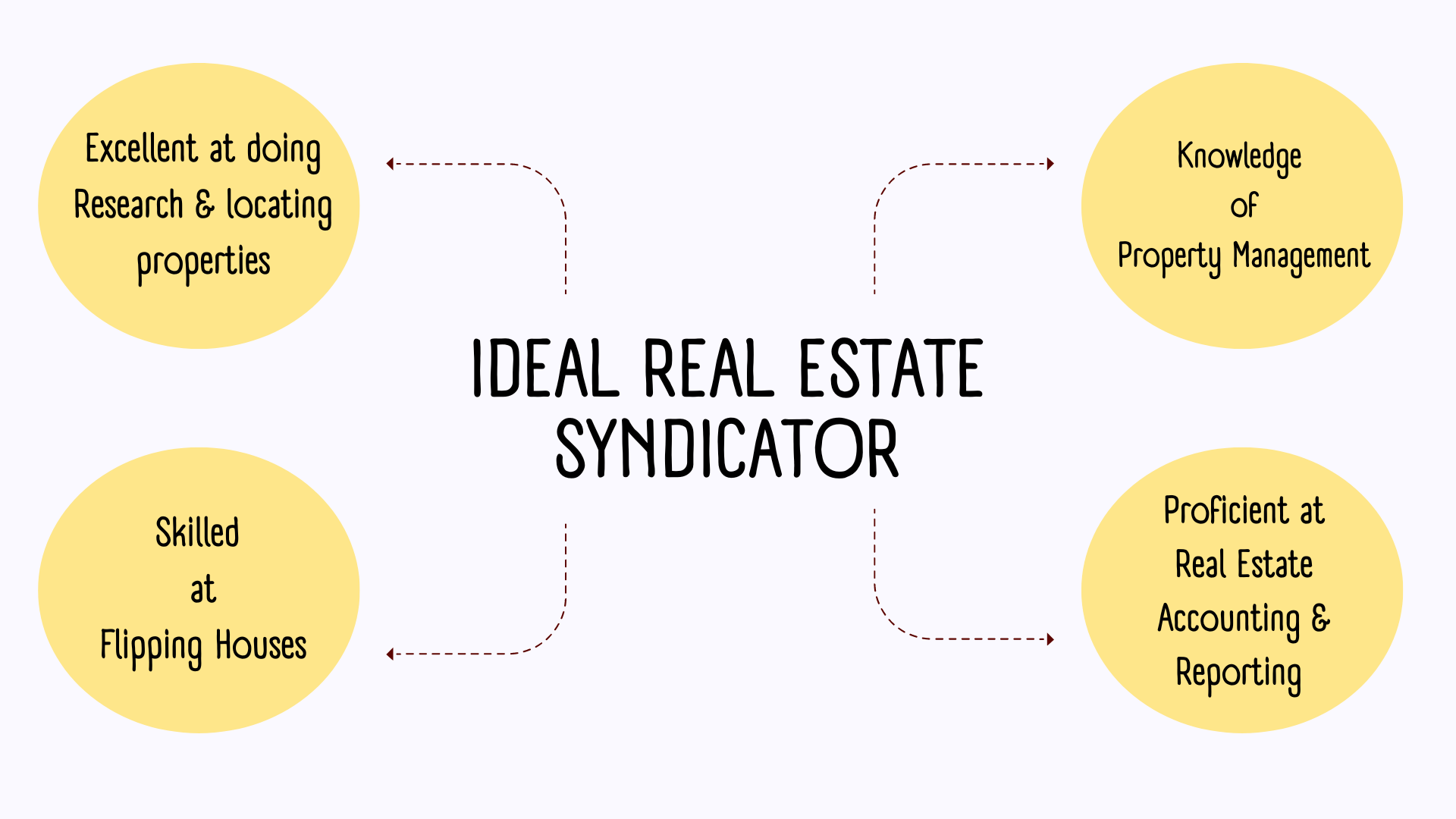

- Sponsor or Syndicator: A seasoned real estate professional or company identifies a promising investment opportunity and creates a syndicate. This sponsor is responsible for managing the property, handling day-to-day operations, and ensuring the investment’s success.

- Investor: You, the small investor, contribute a portion of the total investment amount to the syndicate. This buy-in typically ranges from $50,000 to $500,000, depending on the project’s size and scope.

- Shared Ownership: In exchange for your investment, you receive a share of the property’s ownership and a proportional split of the profits.

- Potential Returns: As the property generates income through rental, appreciation, or other means, you receive a percentage of the returns, proportional to your investment.

The benefits of real estate syndication for small investors are numerous:

- Reduced Risk: By spreading the investment across multiple partners, you minimize your exposure to risk. If one property struggles, the syndicate’s diversified portfolio can help mitigate losses.

- Increased Diversification: Real estate syndication allows you to invest in a variety of properties and asset classes, which can help you build a more balanced portfolio.

- Professional Management: Experienced sponsors handle property management tasks, freeing you from the burdens of direct property ownership.

- Access to Larger Properties: Syndication enables you to invest in larger, more lucrative properties that might be out of reach as a solo investor.

- Predictable Income: Many real estate syndications generate regular income through rental or other steady revenue streams.

- Potential for Passive Appreciation: As the property appreciates in value, you may benefit from long-term capital gains.

To illustrate the power of real estate syndication, consider this example:

- A small investor, Emma, contributes $100,000 to a syndicate investing in a 20-unit apartment complex.

- The syndicate requires a total investment of $2 million, which is split among 20 investors, each contributing $100,000.

- The property generates an annual net operating income (NOI) of $500,000, which is distributed to investors based on their ownership percentage. Emma receives 5% of the NOI, or $25,000 per year.

While real estate syndication is an attractive option, it’s essential to be aware of the following:

- Illiquidity: Real estate investments are generally illiquid, meaning it may take time to sell your shares or access your capital.

- Risk: Although syndication reduces risk, it’s not a risk-free investment. Market fluctuations, property damage, or poor management can still impact returns.

- Fees: Sponsors and syndicators typically charge management fees, which can eat into your returns.