As a parent, saving for your child’s college education is one of the most significant financial milestones you’ll face. With tuition costs skyrocketing and the average student loan debt hovering around $30,000, it’s essential to think outside the box when it comes to building a college fund. One often-overlooked strategy is investing in real estate, which can provide a stable source of wealth and help you secure your child’s higher education.

The Real Estate Advantage

Table of Content

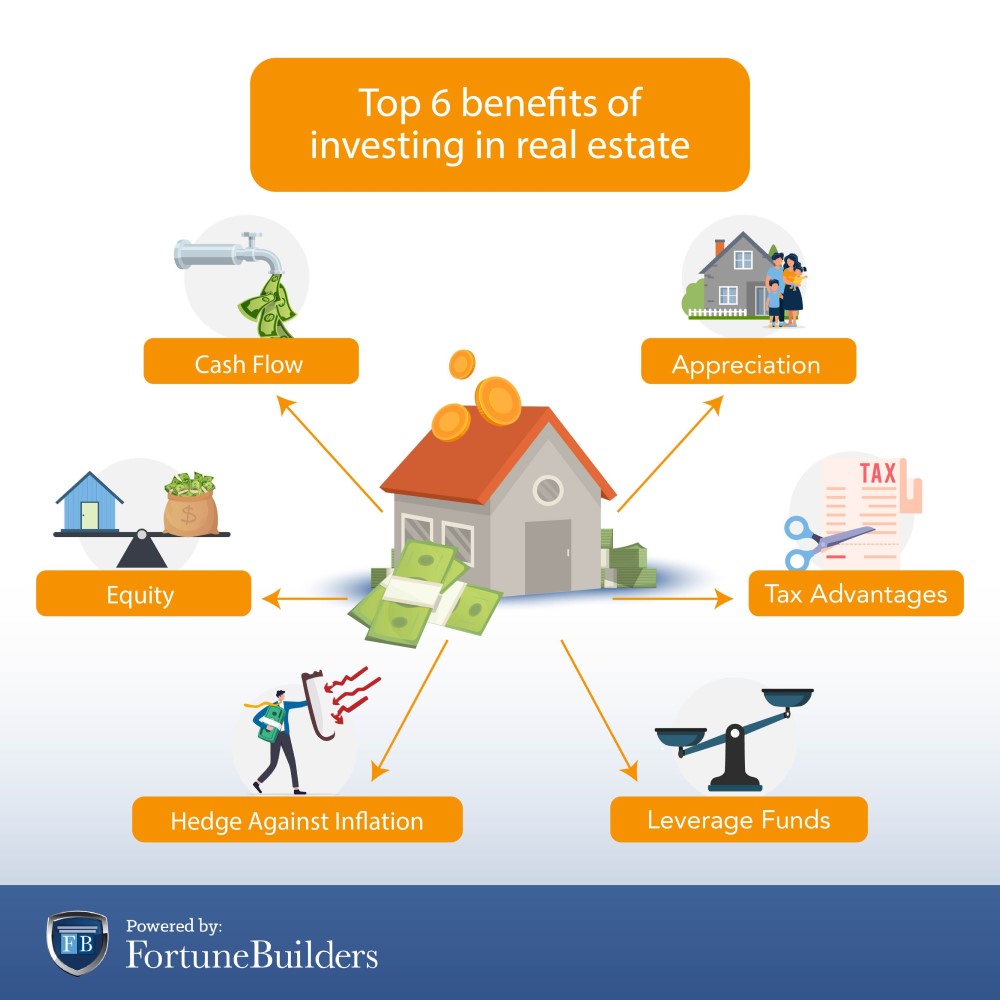

Real estate investing offers several benefits that make it an attractive option for college savings. For one, it provides a tangible asset that can appreciate in value over time, potentially outpacing inflation and other investment options. This means that as the property value increases, so does your wealth, providing a solid foundation for your child’s future.

Another advantage of real estate investing is the rental income it can generate. By renting out the property, you can create a steady stream of income that can be used to offset college expenses or even help pay the mortgage. This can be especially beneficial during the years leading up to your child’s college enrollment, when tuition bills start to pile up.

Real Estate vs. Traditional Investments

When it comes to college savings, many parents opt for traditional investment vehicles like 529 plans or high-yield savings accounts. While these options offer some benefits, they often come with significant drawbacks. For instance, 529 plans can be restrictive in terms of investment options and withdrawal rules, and high-yield savings accounts may not keep pace with inflation or market growth.

Real estate investing, on the other hand, offers more flexibility and control over your investment. You can choose the property type, location, and management strategy that best fits your financial goals and risk tolerance. Additionally, real estate investing allows you to leverage debt (in the form of a mortgage) to amplify your returns, which can be a powerful tool in building wealth.

Strategies for Investing in Real Estate

Investing in real estate for college savings requires some planning and strategy. Here are a few approaches to consider:

- Direct Property Investment: Purchase a rental property or a distressed home that can be renovated and rented out. This approach requires significant capital upfront but can provide substantial returns in the long run.

- Real Estate Investment Trusts (REITs): Invest in a publicly traded REIT, which allows you to pool your money with other investors to fund a diversified portfolio of properties. This option provides liquidity and diversification but typically comes with management fees and lower returns.

- Real Estate Crowdfunding: Platforms like Fundrise or Rich Uncles allow you to invest in real estate development projects or existing properties with lower minimum investment requirements. This approach provides access to real estate investing with lower capital outlays.

Tax Benefits of Real Estate Investing

Real estate investing offers several tax benefits that can help reduce your taxable income and increase your college savings. For instance, mortgage interest and property taxes are deductible expenses on your tax return, which can help lower your taxable income. Additionally, real estate depreciation can provide a paper loss, reducing your taxable income even further.

Conclusion

Investing in real estate can be a savvy strategy for building a college fund, offering a tangible asset that can appreciate in value and generate rental income. While it requires some planning and expertise, the potential benefits far outweigh the drawbacks. By incorporating real estate investing into your college savings plan, you can create a stable source of wealth and help secure your child’s higher education. As a parent, what more could you ask for?