The age-old debate between rental and residential property investments has long been a topic of discussion among real estate enthusiasts. As the property market continues to evolve, it’s essential to examine which type of property yields higher returns. In this article, we’ll delve into the world of rental and residential properties to provide you with a comprehensive comparison.

Rental properties, also known as investment properties, are purchased with the intention of generating rental income. These properties can range from apartments to houses, and even commercial buildings. On the other hand, residential properties are purchased for personal use, often serving as primary or secondary homes. The key difference between the two lies in their purpose and the potential for returns.

Let’s start with rental properties. One of the most significant advantages of rental properties is the potential for steady cash flow. Rental income can provide a regular stream of revenue, which can help offset mortgage payments, property maintenance, and other expenses. Additionally, rental properties can appreciate in value over time, making them a potentially lucrative long-term investment.

However, rental properties also come with their fair share of challenges. Property management can be time-consuming and costly, especially if you hire a property management company. Moreover, rental properties are subject to local market conditions, which can affect rental income and property values. For instance, a downturn in the local economy or an oversupply of rental properties can lead to reduced rental income and decreased property values.

On the other hand, residential properties offer a sense of stability and security. As a primary or secondary home, residential properties provide a place to live and can often appreciate in value over time. However, residential properties typically don’t generate income, as they’re not rented out to tenants. Instead, homeowners rely on appreciation in property value and potential long-term capital gains.

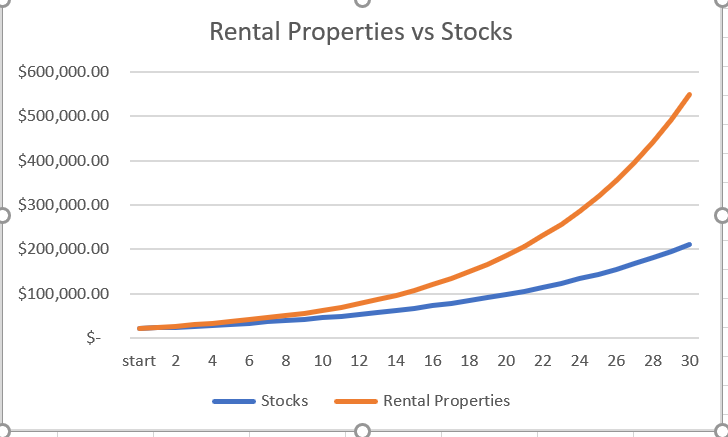

In terms of returns, rental properties often outperform residential properties. According to a study by the National Association of Realtors, rental properties can generate annual returns of 8-10%, while residential properties typically appreciate at a rate of 3-5% per annum. However, these figures can vary significantly depending on local market conditions and property management.

To illustrate the difference in returns, let’s consider an example. Suppose you purchase a rental property for $200,000, with a potential annual rental income of $20,000. After deducting expenses such as mortgage payments, maintenance, and property management fees, you’re left with a net operating income of $10,000. Assuming the property appreciates at a rate of 5% per annum, your total return would be approximately 12% per year.

In contrast, a residential property purchased for $200,000, with no rental income, would likely appreciate at a rate of 3-5% per annum. While this is still a respectable return, it’s lower than the potential returns generated by a rental property.

Ultimately, the decision between a rental property and a residential property depends on your personal financial goals, risk tolerance, and investment strategy. If you’re looking for a steady stream of income and are willing to take on the challenges of property management, a rental property might be the better choice. However, if you prioritize stability and security, a residential property could be the way to go.

Before making a decision, consider the following:

- Local market conditions: Understand the local real estate market, including rental income, property values, and market trends.

- Property management: Calculate the costs and responsibilities associated with property management, including maintenance, repairs, and property management fees.

- Financing options: Explore financing options, such as mortgages and interest rates, to determine the best fit for your investment.

- Risk tolerance: Assess your risk tolerance and ability to withstand market fluctuations and potential losses.

- Investment strategy: Align your investment strategy with your financial goals, risk tolerance, and time horizon.

In conclusion, while both rental and residential properties can offer attractive returns, rental properties often outperform their residential counterparts. However, it’s essential to carefully consider your investment strategy, risk tolerance, and local market conditions before making a decision. Whether you choose a rental property or a residential property, thorough research and planning can help ensure a successful and profitable investment.