Refinancing Your Home: Is Now the Smartest Time to Make a Move?

As a homeowner, it’s natural to wonder whether refinancing your mortgage is the right choice for you. Maybe you’ve been eyeing a lower interest rate or looking to tap into your home’s equity to fund a major project. Whatever your motivation, deciding whether to refinance can be a daunting task. That’s why we’re here to help you weigh the pros and cons and make an informed decision.

So, what is refinancing, exactly? In simple terms, refinancing means replacing your existing mortgage with a new one – often with a different interest rate, loan term, or monthly payment. While it’s not a decision to be taken lightly, refinancing can be a smart move if done at the right time.

When to Consider Refinancing

If you’re still unsure whether refinancing is for you, here are some scenarios that might make it a good option:

-

Rates have dropped: If interest rates have decreased since you took out your original loan, refinancing could save you a bundle on your monthly payments. For instance, if you can snag a lower rate, you might end up with a smaller mortgage bill – or even a larger loan without increasing your payments.

-

Your credit score has improved: A better credit score means better loan terms, which could result in lower interest rates or more favorable repayment conditions. By refinancing, you might be able to capitalize on your improved credit history and enjoy more manageable payments.

-

You need cash for renovations or repairs: If you’re planning a major home renovation or need to fix a costly issue, a cash-out refinance can be a convenient way to access your home’s equity. You can borrow against your property’s value and use the funds to cover the expenses.

-

You’re looking to switch from an ARM to a fixed-rate loan: If you’re currently in an adjustable-rate mortgage (ARM) and worried about rising interest rates, refinancing to a fixed-rate loan can provide peace of mind and shield you from future rate increases.

-

You’ve built up significant equity: If you’ve made substantial payments on your mortgage and built up a lot of equity, refinancing can help you tap into that value and put it towards other goals – like funding a retirement account, paying off debt, or even buying a second home.

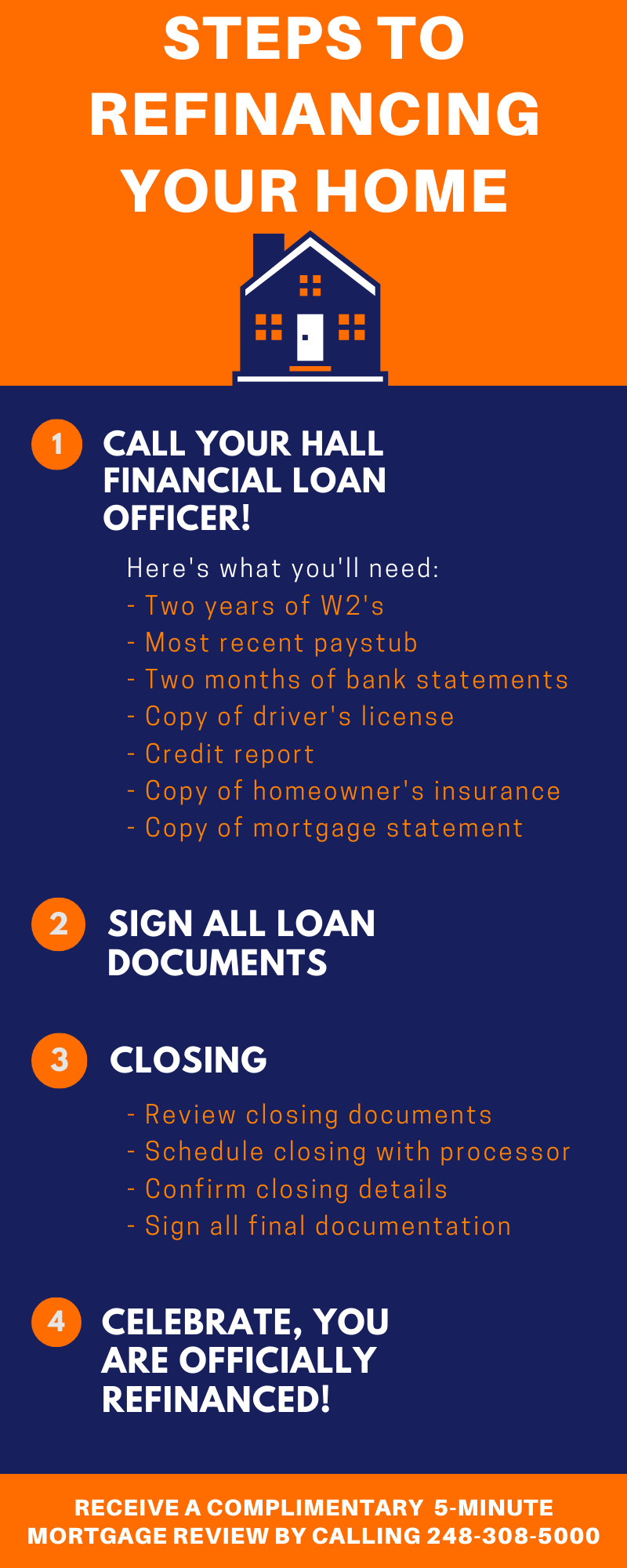

What to Expect from the Refinancing Process

Refinancing can seem like a complex and time-consuming process, but it’s generally similar to what you went through when you first applied for your mortgage. Here’s a quick rundown of what to expect:

-

Pre-approval and pre-qualification: Before applying, you’ll typically go through a pre-approval or pre-qualification process with a lender. This gives you an idea of how much you’ll qualify for and what your interest rate might be.

-

Application and underwriting: Once you’ve found a lender and selected a loan option, you’ll need to submit a formal application. The lender will review your financial information, credit history, and property appraisal to make a final decision.