Real Estate Strategies for the High-Income Earner: Think Beyond the Basics

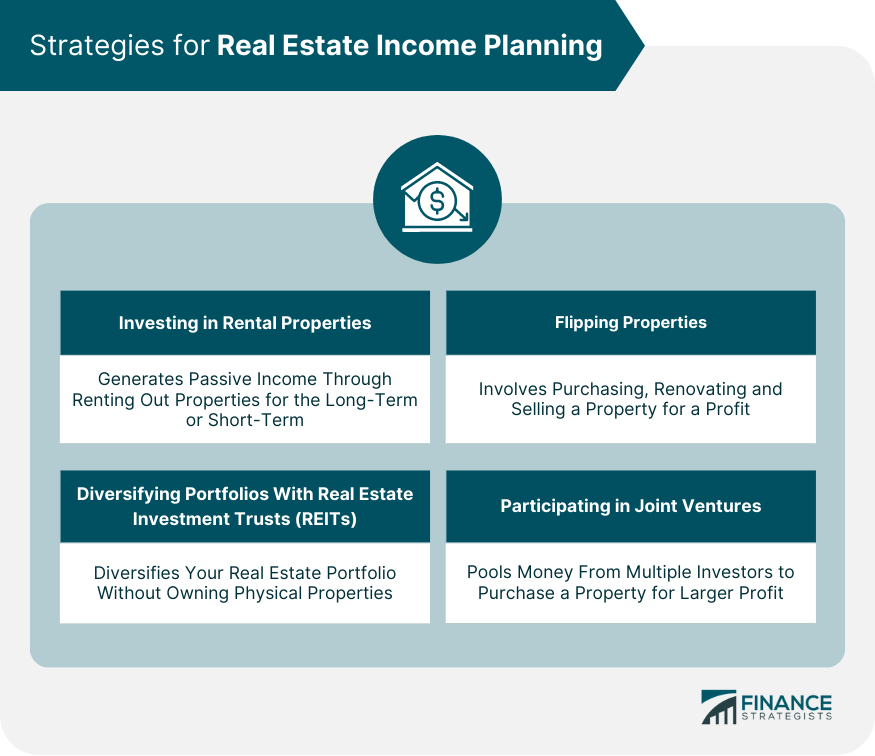

For high-income earners, investing in real estate can be a smart way to diversify their assets and grow their wealth over time. However, it’s essential to think beyond the basics of buying a rental property or flipping a house. Successful real estate investors need to stay ahead of the curve, taking advantage of nuanced strategies that minimize risk and maximize returns.

Leveraging the 1031 Exchange

One often-overlooked strategy for high-income earners is the 1031 exchange. Also known as a "like-kind" exchange, this technique allows investors to swap one investment property for another without paying capital gains taxes. This can be particularly beneficial for high-income earners who have substantial capital tied up in a single property and want to diversify their portfolio without triggering a tax liability.

For example, imagine a successful business owner who invested in a commercial property several years ago. If they sell the property for a significant profit, they may face substantial capital gains taxes. However, by using a 1031 exchange to swap the property for a similar investment, they can defer the taxes and reinvest the capital in a new opportunity.

The Fundamentals of Real Estate Crowdfunding

Another strategy for high-income earners is real estate crowdfunding. Platforms like Fundrise, Rich Uncles, or RealtyMogul allow accredited investors to pool their resources and invest in large-scale real estate projects, from multifamily developments to commercial properties. By investing in a diversified portfolio of properties, high-income earners can spread their risk and increase their potential returns.

Moreover, real estate crowdfunding platforms often provide access to properties that would be out of reach for individual investors. By leveraging the collective power of the crowdfunding community, high-income earners can invest in high-end properties with minimal upfront capital.

Tax-Advantaged Real Estate Investing

High-income earners should also consider tax-advantaged real estate investing strategies. For instance, a self-directed IRA (SDIRA) allows investors to hold real estate assets within a tax-deferred retirement account. By using a SDIRA to invest in real estate, high-income earners can potentially reduce their tax liability and grow their wealth faster.

Another option is a Limited Liability Company (LLC) or a family limited partnership (FLP). These entities can provide an additional layer of tax efficiency and asset protection, allowing high-income earners to pass wealth to future generations while minimizing taxes.

Investing in Opportunity Zones

The 2017 Tax Cuts and Jobs Act created a new type of tax-advantaged investment vehicle: Opportunity Zones (OZs). These economically distressed areas offer tax benefits to investors who commit capital to projects within the zones. High-income earners can invest in OZs through funds or individual projects, enjoying tax deferrals and potential long-term appreciation in property values.

Opportunity Zones can be particularly attractive to high-income earners who want to support economic development in underserved communities while generating returns on their investment. By combining social impact with financial returns, OZs offer a unique value proposition that aligns with the values of many high-income earners.

Real Estate Investing for the Ultra-Wealthy

Finally, high-income earners with significant assets may want to consider bespoke real estate investing strategies. For example, a high-net-worth individual might invest in a bespoke real estate fund, partnering with a seasoned investment manager to create a customized portfolio of properties tailored to their specific goals and risk tolerance.

Alternatively, ultra-high-net-worth individuals might consider investing in a private real estate company or developing a real estate platform from scratch. This approach allows them to leverage their resources, expertise, and network to create a real estate business that aligns with their values and investment objectives.

In conclusion, high-income earners who want to maximize their real estate investments need to think beyond the basics. By leveraging strategies like the 1031 exchange, real estate crowdfunding, tax-advantaged investing, and Opportunity Zones, they can create a diversified portfolio that generates strong returns while minimizing risk. Whether through bespoke investing or more conventional approaches, the key is to be proactive, adaptable, and informed in the ever-changing world of real estate investing.