The ebbs and flows of the real estate market can be a daunting prospect for even the most seasoned investors. Market cycles, which can last anywhere from a few years to decades, are a natural part of the real estate landscape. Understanding and navigating these cycles is crucial for making informed investment decisions that can help you ride out the storms and capitalize on the boom times.

Recognizing the Cycles

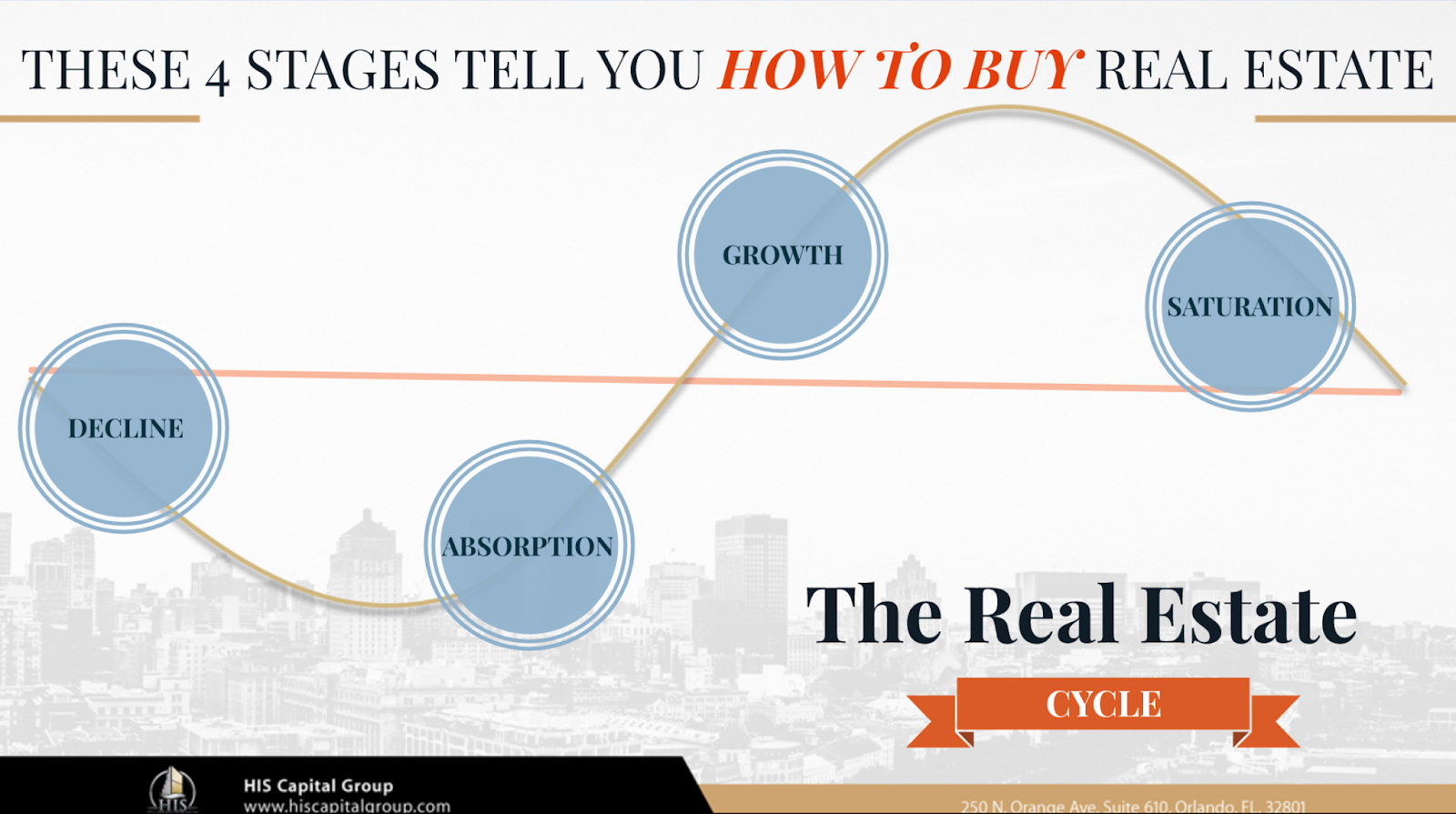

Real estate market cycles are typically characterized by four phases:

- Expansion: This is the growth phase, where demand for housing is high, and prices are on the rise. It’s often fueled by a strong economy, low interest rates, and high employment rates. During this phase, builders and investors are active, and new developments are underway.

- Peak: As the expansion phase reaches its peak, prices become unsustainable, and investors start to take a step back. Builders begin to wind down their construction activities, and buyers become fewer and farther between.

- Contraction: This phase is marked by a market correction, where prices drop, and demand slows. It’s during this phase that investors may start to bail on their assets or take significant losses.

- Trough: In the final phase, the market bottom has been reached, and prices have stabilized. It’s often characterized by low demand, but those who are willing to invest may find great opportunities.

Key Factors that Influence Market Cycles

So, what triggers these cycles? Here are some of the key factors to watch out for:

- Interest Rates: One of the primary drivers of market cycles is interest rates. When rates are low, more people can afford to buy or invest in real estate, spurring growth. Conversely, high interest rates make buying or investing more expensive.

- Economic Indicators: The state of the economy plays a significant role in shaping market cycles. A strong economy with low unemployment and high GDP growth can fuel expansion phases.

- Housing Supply: An oversupply of housing can lead to a market correction, while an undersupply can fuel a expansion phase.

- Demographic Trends: Demographic changes, such as shifting age or family structures, can significantly impact demand for housing.

Strategies for Navigating Market Cycles

So, what can investors do to make the most of market cycles?

- Buy Low: One of the most effective strategies is to buy property during the trough phase, when prices are at their lowest. This provides an excellent opportunity to maximize returns on your investment.

- Sell High: On the flip side, consider selling your properties during the peak phase, when prices are at their highest.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across various sectors, such as residential, commercial, or industrial, to minimize risk.

- Rentals: Consider holding onto your properties and renting them out during the contraction phase, generating passive income.

- Value-Add: Look for undervalued properties that can be renovated or repositioned to take advantage of shifting market trends.

Staying Ahead of the Curve

Staying informed and up-to-date on market trends is vital for navigating market cycles. Keep an ear to the ground for news and updates on:

- Economic indicators