Imagine a real estate market where investment was scarce, job growth was stagnant, and local businesses struggled to stay afloat. These areas, often overlooked by investors and developers, presented a puzzle – how to revitalize and stimulate economic growth without relying on handouts or government aid.

One solution, introduced in the United States in 2017 as part of the Tax Cuts and Jobs Act, aimed to breathe life into these neglected neighborhoods – Opportunity Zones (OZs). The program’s objective was twofold: lure investors into these undervalued areas by offering attractive tax incentives, and channel that investment into local economic growth, job creation, and community development.

So, what exactly are Opportunity Zones and how do they work?

Opportunity Zones are census tracts – classified as economically distressed – designated by state and local governments. To qualify, these areas had to meet specific low-income and poverty requirements. Once identified, they were nominated to the US Treasury Department for inclusion in the OZ program. With this designation comes a golden ticket for investors – the potential to defray capital gains taxes by investing in these targeted areas.

Here’s how it works: If you invest in an Opportunity Fund – an investment vehicle set up specifically for OZ investments – you can delay paying taxes on capital gains. These gains, earned from the sale of stocks, real estate, or other appreciable assets, typically would trigger a tax obligation. In an OZ investment, you can roll those gains into the Opportunity Fund, postponing the payment of capital gains taxes until December 31, 2026 or when the investment is sold – whichever comes first.

But there’s more to the OZ allure: depending on how long the investment is held in the Opportunity Fund, investors can enjoy substantial, permanent tax reductions. A five-year holding period earns a 10% tax reduction on the original capital gain, increasing to 15% if the investment is held for seven years. The biggest reward? If the investment is held for at least a decade, the investor pays zero capital gains on any profits earned – an outcome that could translate into millions in tax savings.

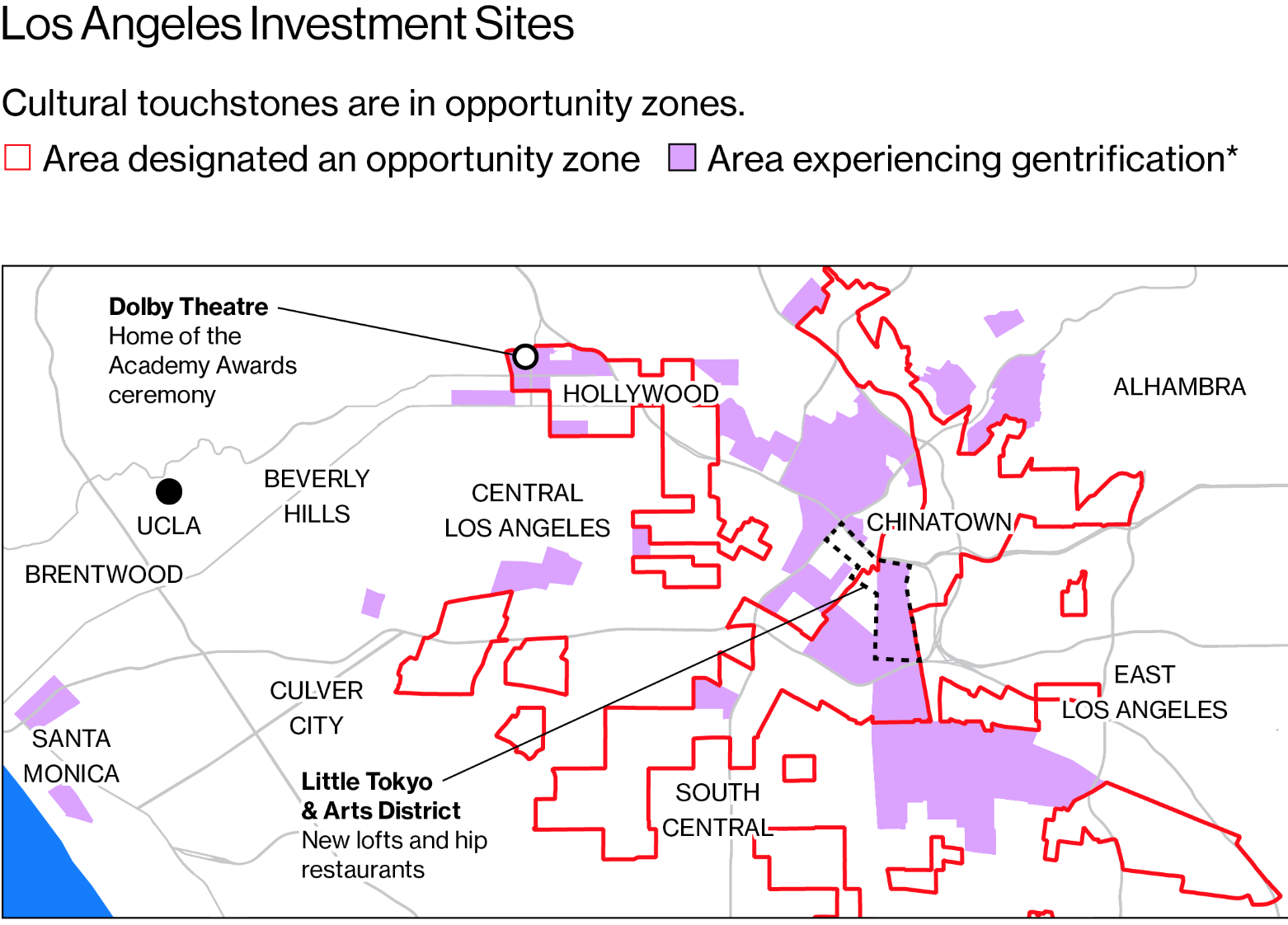

Despite this favorable tax climate, finding the right Opportunity Zone investment is not without its pitfalls. Much of the OZ landscape consists of neglected neighborhoods and underdeveloped properties – high-risk areas that demand meticulous research and hands-on management. Due diligence becomes essential in identifying areas with growth potential and mitigating potential downsides – think entrenched poverty, crime, or failing local infrastructure.

As a savvy investor, you’ll need to navigate the delicate balance of social responsibility, risk tolerance, and financial returns. Target neighborhoods that have demonstrated promise – growing entrepreneurship, new business developments, or a budding arts scene. Conversely, be cautious of areas strained by bureaucratic red tape or troubled by potential environmental hazards.

As with any high-reward investment, Opportunity Zones also hold risks. As communities evolve and investment pours in, existing residents may be displaced – pushed out by rising rents and widening income disparities. This escalating gentrification poses tough questions for would-be investors: How can investment improve without hurting locals? Can affluent newcomers coexist with long-term residents? Are ways to balance economic growth and affordability available?

While these questions remain to be answered fully, one aspect is clear: Opportunity Zones represent a unique confluence of self-interest and social responsibility. As an investor, you have the chance to revitalize derelict neighborhoods, boost local prosperity, and earn significant tax advantages – all while contributing to a program built on the idea that growth can be both equitable and profitable.