Cashing In on the Multi-Family Life

If you’re a real estate investor with a vision to grow your portfolio, then multi-family properties are an excellent option to consider. These types of properties can provide steady cash flow through rental income, appreciate in value over time, and offer economies of scale. However, without a solid strategy, it’s easy to get caught up in financial turmoil. In this article, we’ll share insider tips and a step-by-step guide on how to successfully buy and rent out multi-family properties.

Why Invest in Multi-Family Properties?

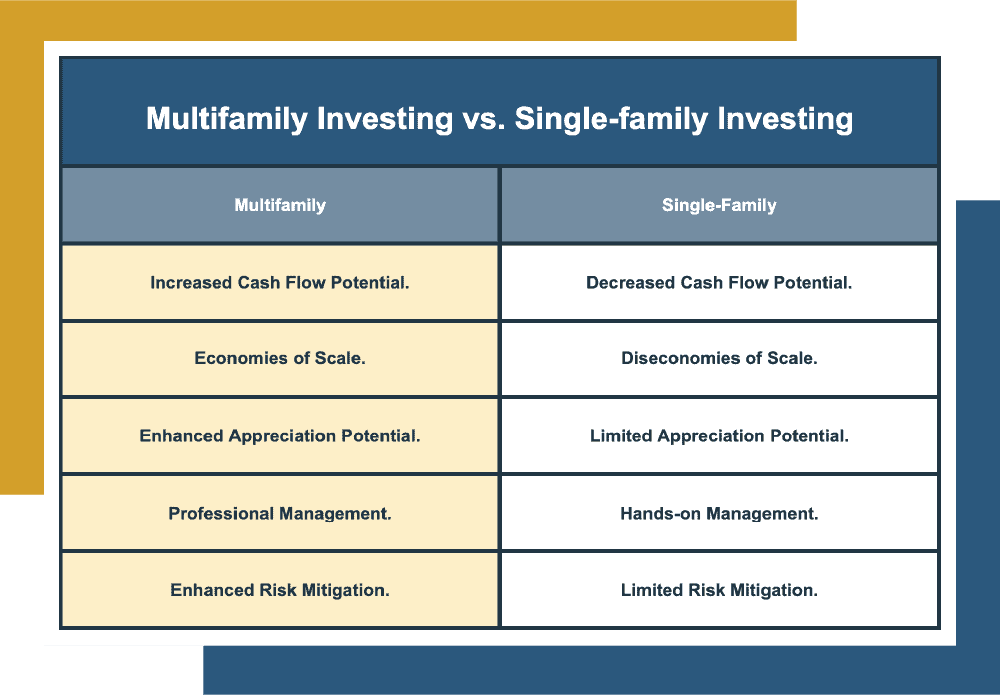

Multi-family properties, including apartment buildings, townhouses, and duplexes, are a smart investment for many reasons:

- Scalability: With multiple units in one location, it’s easier to manage and maintain your investment.

- Diversified Rental Income: Spread your risk across multiple tenants and rental income streams.

- Appreciation: Multi-family properties tend to appreciate in value over time, making them a solid long-term investment.

- Economies of Scale: By acquiring a multi-family property, you can negotiate better deals on insurance, financing, and maintenance.

Step 1: Identify the Right Market

Location is everything when it comes to investing in multi-family properties. Research neighborhoods with a strong demand for rentals, good schools, and local amenities. Look for areas with:

- Growth Potential: Growing cities or revitalized neighborhoods with new businesses and developments.

- Affordability: Areas with manageable property prices and competitive rental yields.

- Rental Market Performance: A stable and relatively low vacancy rate.

Some of the best markets to invest in include:

- Up-and-coming neighborhoods in major cities like Denver, CO; Austin, TX; and Portland, OR.

- Revitalized cities like Detroit, MI; St. Louis, MO; and Kansas City, MO.

- College towns and smaller cities with growing populations and rental demand.

Step 2: Secure Financing

When it comes to financing a multi-family property, traditional loans might not be the best option. You may need to explore alternative options, such as:

- Commercial Real Estate Loans: Offer more flexible terms and lower interest rates than traditional loans.

- Partner with Investors: Pool funds with fellow investors or seek out private investors to co-sign the loan.

- Take Advantage of Tax Benefits: Utilize tax-deferred 1031 exchanges or negotiate seller financing.