Calculating Return on Investment in Real Estate: A Beginner’s Guide to Maximizing Your Gains

Real estate investing – the key to building wealth, creating passive income streams, and securing your financial future. But how do you measure the success of your investment? Enter Return on Investment (ROI), the ultimate metric for determining whether your property is a lucrative venture or a drain on your resources.

Table of Content

In this article, we’ll delve into the world of real estate ROI, exploring what it means, why it matters, and most importantly, how to calculate it. Whether you’re a seasoned investor or just starting out, understanding ROI will empower you to make informed decisions and maximize your returns.

What is Return on Investment in Real Estate?

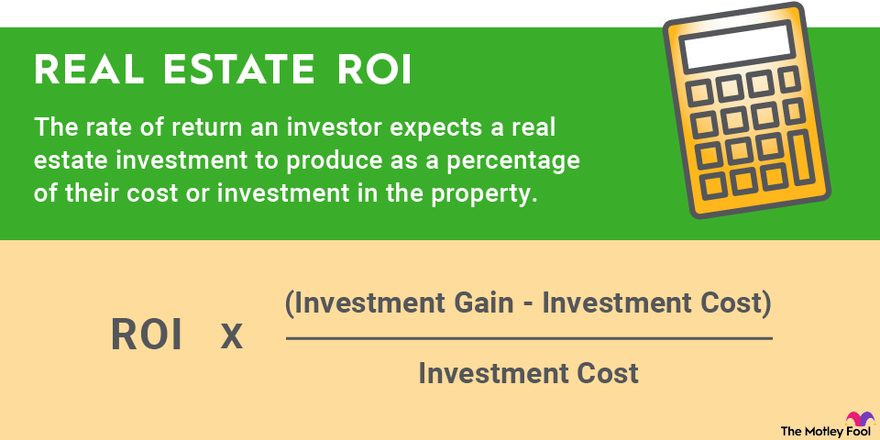

ROI is a simple yet powerful concept that measures the profit of an investment as a percentage of its cost. In real estate, ROI calculates the annual returns on a property, factoring in rental income, expenses, and the initial investment. Think of it as a report card for your investment, revealing whether your strategy is on track or needs adjustment.

Why Does ROI Matter in Real Estate?

Knowing your ROI in real estate is crucial for several reasons:

- Comparing investments: ROI allows you to compare the performance of different properties, identifying which ones generate the highest returns.

- Evaluating risk: By calculating ROI, you can assess the risks associated with an investment, making more informed decisions about your portfolio.

- Improving strategy: ROI analysis helps you pinpoint areas for improvement, streamlining expenses, and optimizing cash flow.

How to Calculate ROI in Real Estate

Now that we’ve covered the what and why, it’s time to tackle the how. Calculating ROI in real estate involves a straightforward formula:

ROI = (Annual Rental Income – Annual Expenses) / Total Investment × 100

Here’s a step-by-step breakdown of the formula:

- Annual Rental Income: Calculate the total rental income generated by your property over a year. Include any additional sources of revenue, such as parking or storage.

-

Annual Expenses: Tally up the total expenses associated with owning and maintaining the property, including:

- Mortgage payments

- Property taxes

- Insurance

- Maintenance and repairs

- Management fees

- Utilities

- Total Investment: Determine the total amount invested in the property, including the purchase price, closing costs, and any renovations or upgrades.

- ROI Calculation: Subtract the annual expenses from the annual rental income, then divide the result by the total investment. Multiply the answer by 100 to express it as a percentage.