Buying Power in the Balance: How Mortgage Interest Rates Affect Your Dream Home

If you’re in the market for a new home, you’ve probably already thought about how much you can afford to spend. But have you considered how mortgage interest rates might impact your buying power? The answer might surprise you.

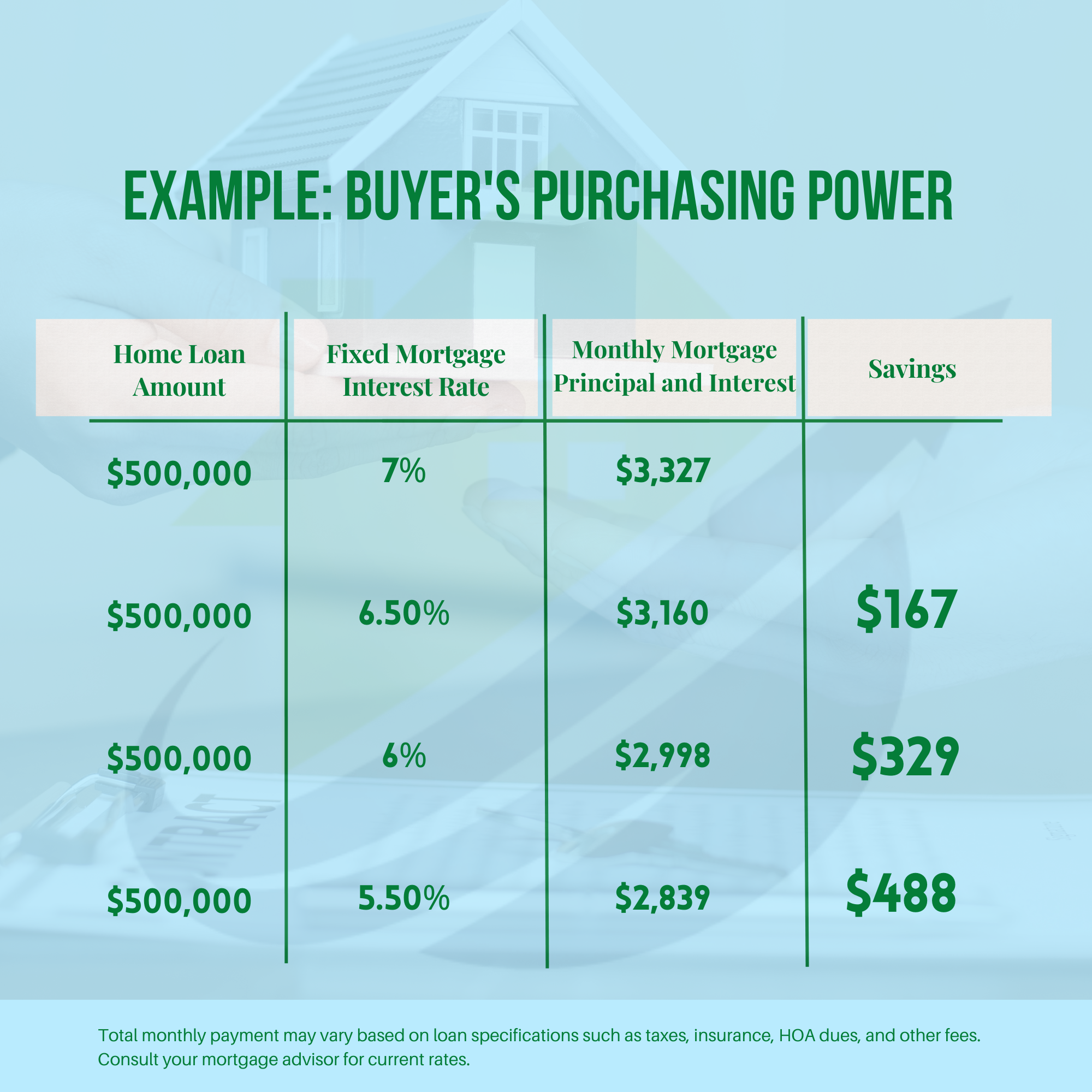

Mortgage interest rates can have a significant effect on your purchasing power, and even a small change in rates can make a big difference in the amount of home you can afford. Let’s dive into the details and explore how mortgage interest rates affect your buying power.

The Rate Game

Mortgage interest rates are influenced by a variety of factors, including inflation, the overall state of the economy, and monetary policy decisions made by central banks. When interest rates are low, it’s generally easier to qualify for a mortgage, and you may be able to afford more home than you could when rates are high.

On the other hand, when interest rates are high, you may find that your purchasing power is reduced. This is because a larger portion of your monthly mortgage payment will go towards paying interest, rather than principal.

A $10,000 Increase in Price

To illustrate the impact of interest rates on buying power, let’s consider an example. Suppose you’re looking at two different mortgage options: one with an interest rate of 4% and another with a rate of 5%. Both options are for a $400,000 home, with a 20% down payment ($80,000) and a 30-year mortgage.

Assuming a fixed interest rate and a standard amortization schedule, here are the monthly mortgage payments for each option:

- 4% interest rate: $1,955 per month

- 5% interest rate: $2,147 per month

As you can see, a 1% increase in interest rate translates to a $192 increase in monthly mortgage payment. That may not seem like a lot, but over the life of the loan (30 years), it adds up to $69,600 in additional interest payments.

Now, let’s talk about how this affects your buying power. Assuming a fixed monthly budget ($1,955) and the same 20% down payment, here’s how much home you could afford at each interest rate:

- 4% interest rate: $400,000

- 5% interest rate: $370,000

As you can see, a 1% increase in interest rate means that you can afford $30,000 less in home value. That’s a significant difference in buying power!

Finding the Right Rate

When shopping for a mortgage, it’s essential to compare rates from different lenders and find the best one for your situation. Consider the following tips to help you navigate the process:

- Work with a reputable lender or mortgage broker who has access to competitive rates.

- Consider a lender that offers mortgage rate matching or a "best rate guarantee."

- Don’t be afraid to shop around and compare rates from multiple lenders.

- Consider working with a financial advisor or mortgage consultant who can help you navigate the process.

Tips for Maintaining Buying Power

If you’re concerned about the impact of rising interest rates on your buying power, here are a few strategies to keep in mind: