Assessing the Rental Potential of a Property: What to Look Out For

If you’re considering investing in a rental property, it’s crucial to assess its potential to generate a steady income stream. Evaluating a property’s rental potential requires careful consideration of various factors, from its location to its size and condition. In this article, we’ll walk you through the key elements to help you determine whether a property has what it takes to be a lucrative rental investment.

Location: The Make-or-Break Factor

The location of a rental property can significantly impact its potential for generating rental income. A property situated in a desirable neighborhood, close to public transportation, schools, and amenities, is likely to be in high demand among renters. Look for areas with a strong local economy, low crime rates, and a growing population.

On the other hand, a property located in a remote or declining area may struggle to attract renters, leaving you with a vacant property and no rental income to speak of. Even if the property itself is beautiful, a poor location can make it a tough sell to potential renters.

Assessing the Property’s Condition and Size

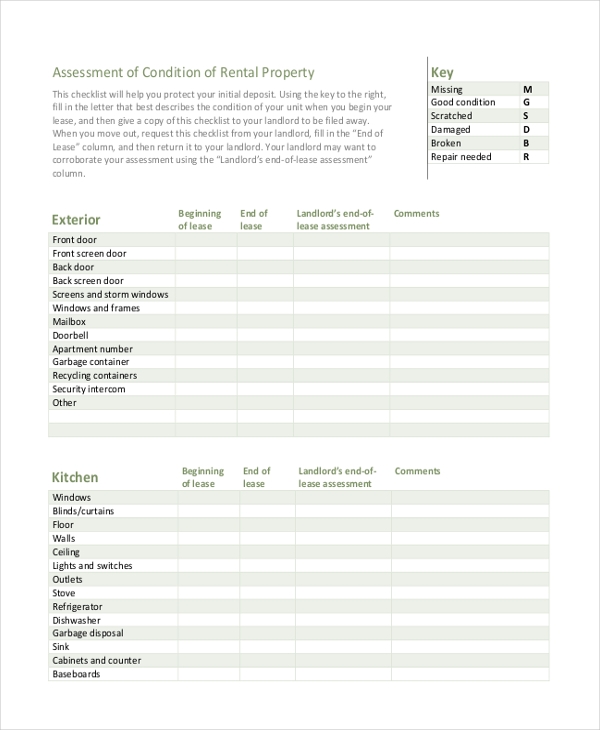

The condition and size of the property are also vital factors to consider when evaluating its rental potential. A well-maintained property with modern amenities and a comfortable living space is likely to attract higher rents and more reliable tenants.

On the other hand, a property that needs significant repairs or renovations may be a money pit, draining your resources and eating into your potential rental income. In addition, a property that’s too small or too large for the location may be harder to rent out, especially if it’s not in line with the local market rates.

Researching the Local Rental Market

Understanding the local rental market is crucial to determining the rental potential of a property. Research the average rent prices in the area, as well as the vacancy rates and tenant turnover rates. This information will give you an idea of what you can expect in terms of rental income and the length of time the property will be occupied.

You can gather this information by talking to local real estate agents, property managers, or by conducting online research. Websites like Zillow, Redfin, and Realtor.com can provide valuable insights into the local rental market, including rent prices, vacancy rates, and more.

Evaluating the Property’s Amenities and Features

The amenities and features of a property can also impact its rental potential. A property with modern amenities like a pool, gym, or in-unit laundry is likely to attract more renters and command higher rents. Similarly, a property with energy-efficient features or sustainable materials may appeal to environmentally conscious renters and command a premium rental rate.

However, it’s essential to consider the additional costs associated with maintaining these amenities. For example, a pool or gym may require regular maintenance and upkeep, which could eat into your rental income.

Assessing the Property’s Expenses

Finally, it’s essential to assess the expenses associated with owning and maintaining the property. These expenses include property taxes, insurance, maintenance and repair costs, and any homeowners association fees.

Your goal is to ensure that the rental income generated by the property is sufficient to cover these expenses and provide a decent return on your investment. A general rule of thumb is to aim for a minimum of 1% to 2% return on investment per year.

Conclusion

Assessing the rental potential of a property requires careful consideration of various factors, from its location to its condition and size. By researching the local rental market, evaluating the property’s amenities and features, and assessing its expenses, you can get a better understanding of whether a property has what it takes to generate a steady income stream.

Remember, investing in a rental property is a significant decision, and it’s essential to approach it with caution and careful consideration. By doing your due diligence and evaluating the property’s rental potential, you can make an informed decision and potentially reap the rewards of a successful rental investment.